Rethinking Enrollment Deposits: Do They Solidify Yield or Create Barriers?

As colleges and universities continue to face increasing competition for a shrinking pool of college-bound students, enrollment leaders are reexamining long-held practices to improve yield and reduce summer melt. One area drawing renewed attention: the role of enrollment deposits.

Do required deposits actually lead to stronger commitment and improved yield? Or are they an unnecessary barrier — particularly for students already navigating affordability concerns?

A recent SightLine analysis of 1,540 institutions, with data compiled and shared publicly by MeetYourClass combined with IPEDS data, offers compelling evidence that challenges conventional wisdom around deposits. In particular, the data raise important questions for institutions with lower yield rates and mid-sized undergraduate populations. Deposit policies are certainly not the only, or even the most important, variable in driving enrollment growth, but it is a piece of the puzzle that should be evaluated.

Analyzing the Data

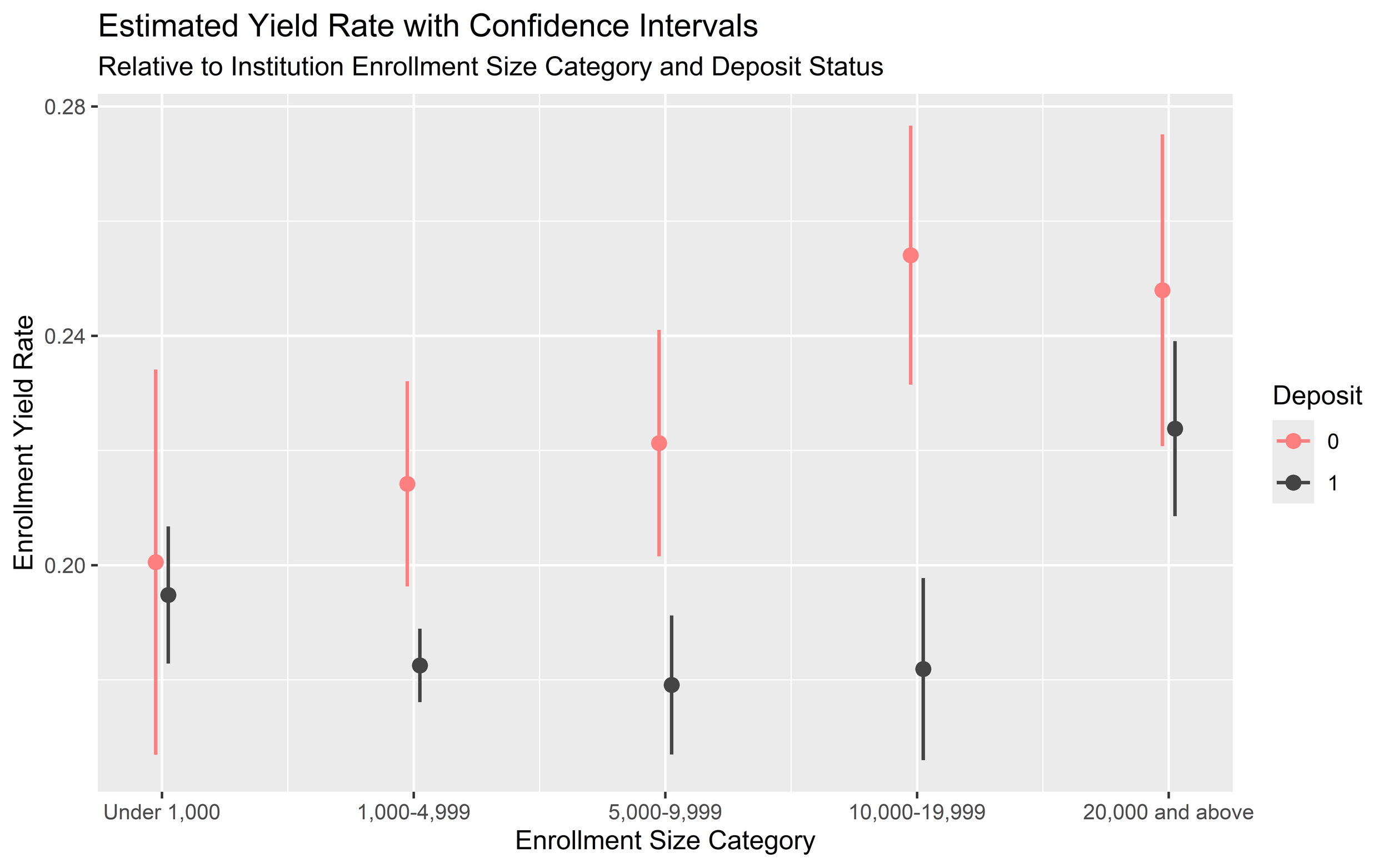

We conducted an ANOVA (Analysis of Variance) comparing the yield rates of institutions that require enrollment deposits versus those that do not, focusing specifically on schools with overall yield rates below 40%.

The results were statistically significant.

Among this group, institutions with 1,000 to 20,000 total undergraduates enrolled that did not require deposits experienced higher average yield rates than those that did. Notably, this segment includes many regional public universities and tuition-dependent privates.

This analysis suggests that at many institutions with less than 40% yield rates, deposit requirements may be counterproductive — potentially contributing to lower enrollment conversion rates.

Why Do Many Universities Require Deposits?

Colleges and universities typically require enrollment deposits as a way to confirm a student’s intent to enroll. These deposits — usually between $100 and $500 — serve two main purposes: they help institutions plan for incoming class sizes, housing, and course needs, and they act as a psychological commitment device, encouraging students to follow through on their decision.

1. Enrollment Planning Tool

The primary reason colleges and universities require enrollment deposits is operational:

Signal of Intent: Deposits serve as a firm (but not legally binding) indicator that an admitted student intends to enroll.

Forecasting: They help enrollment managers project incoming class size, housing needs, course section planning, and orientation logistics.

Budgeting: Tuition-dependent institutions, especially small private colleges, rely on early deposits to plan financial aid disbursements and cash flow.

Most deposits are due by May 1st (National Decision Day), a timeline that aligns with the cycle of financial aid packaging and high school graduation schedules, reinforcing its role as a key point for both university teams and students.

2. Psychological Commitment Device

Many in the industry also view deposits as psychological nudges:

Skin in the Game: Requiring a student to make a financial commitment — even a small one — increases the likelihood of follow-through.

Behavioral economics: The deposit is seen as a “sunk cost” that makes the student less likely to reverse course or melt over the summer.

"Closing the Deal": From a recruitment perspective, a deposit can serve the same function as a signature on a dotted line — a public commitment that makes it harder to back out emotionally.

This psychological framing is common in admissions circles, particularly in competitive markets or among tuition-reliant institutions that need to manage melt risk.

While longstanding in higher education, the practice is now being reevaluated as institutions balance enrollment certainty with a growing push to reduce financial barriers for students.

Understanding the Why: Deposits as Barriers to Entry

While deposits have long been used as signals of intent, they may no longer serve that role effectively in today’s enrollment environment. Instead, they can introduce friction in the decision-making process, especially for students from low- and moderate-income backgrounds.

Key considerations:

Financial burden: While the average deposit in the dataset was $270 (with a median of $230), even modest upfront costs can be a deterrent for students managing multiple college decisions, financial aid uncertainty, or competing household priorities.

Delayed decision-making: For some students, a required deposit becomes a logistical hurdle rather than a meaningful commitment.

Equity concerns: Required deposits may disproportionately impact first-generation students and those eligible for Pell Grants — the exact populations institutions are trying to better serve.

Strategic Implications for Enrollment Leaders

Our results call for a more nuanced, student-centered approach to commitment-building. Rather than relying on financial deposits as a proxy for intent, institutions should consider alternative strategies to foster connection, clarity, and confidence among admitted students.

SightLine recommends that institutions:

Reevaluate deposit policies, particularly if yield rates are below 40% or if recent cycles have seen increases in melt or declining yield rates.

Invest in engagement strategies that foster belonging, such as personalized communications, peer-to-peer onboarding, and early advising outreach.

Identify alternative data sources for understanding and better forecasting student intent to enroll, such as social and community-based data.

By shifting focus from financial commitment to relational engagement, institutions can better align their enrollment strategies with students’ needs — and improve yield outcomes in the process.

Final Thoughts

Our statistical findings from the MeetYourClass dataset offer a timely reminder that legacy practices must evolve alongside student expectations and enrollment dynamics. In many cases, removing barriers like required deposits may not just improve access — it may also improve yield.

At SightLine, we help institutions build data-driven enrollment strategies that support both institutional goals and student success. If your team is considering changes to deposit policies, we can help assess the potential impact through scenario modeling, predictive analytics, and student behavior insights.

Reducing friction. Enhancing belonging. Improving outcomes. That’s the future of yield strategy.